Federally-required startwork documents demand the time and attention of onboarding professionals worldwide.

For over a decade, the focus on streamlining and centralizing these document retrieval and storage processes has grown. However, the state-to-state nuance and legalities surrounding some of these practices have made it difficult, and gaps in understanding have, at times, put organizations at risk.

Since 1986, the Form I-9 document has been required from all citizen and non-citizen hires as part of the necessary startwork.

Let’s Start With Some I-9 Basics & Need-to-Knows

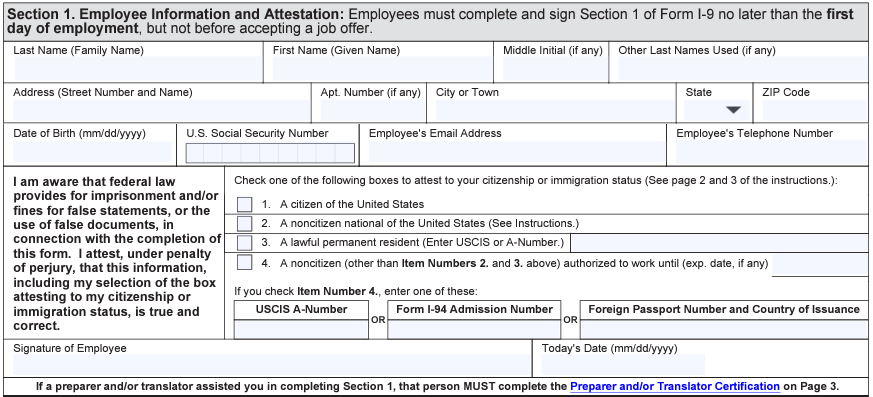

Section 1: Employee Information and Attestation

Employees must complete and sign Section 1 of Form I-9 no later than their first day of employment. Employees must provide the following:

- Full legal name

- Alias names used

- Current Address

- DOB

- Citizenship/immigration status

- Date and signature

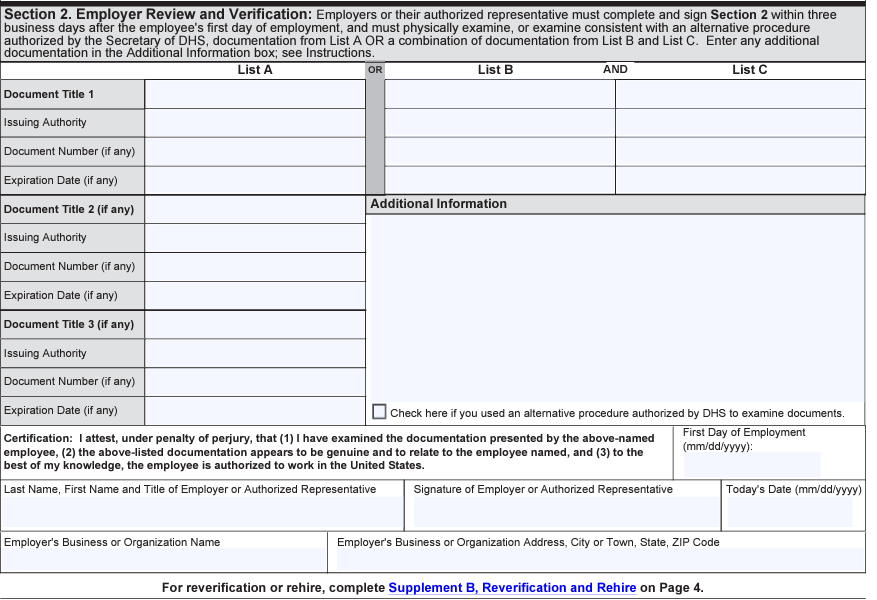

Section 2: Employer or Authorized Representative Review and Verification

Employers (or authorized representatives) must complete Section 2 of Form I-9 within three (3) days of the employee’s first day of work or pay.

As part of Section 2, the employee must provide:

- One document from List A

- One document from List B and one document from List B

*You can find a list of acceptable documents here.

As part of Section 2, the employer must:

- Examine documentation and ensure it is original

- Determine if documentation reasonably appears to be genuine

- Enter document information into respective fields

- Enter employee start date

- Enter information of the individual completing Section 2 along with the date of completion

- Enter employer information

- Return documents to the employee

Authorized Representative

An employer can designate an authorized representative to complete, correct, or update Section 2 on their behalf. This representative may be any member of the general public. However, employees cannot act as authorized representatives for their own Form I-9. Employers are liable for any mistakes or violations committed by the authorized representative.

Supplement A

This is only completed by an individual who aids an employee with translating Section 1 (if applicable).

Supplement B

Employers complete this in the event of a rehire or re-verification.

I-9 Document Management & Storage

The employer is responsible for ensuring each Form I-9 is properly completed and stored. Never dispose of the Form I-9 of an active employee. Form I-9 must be retained for each hire for three years after the date of hire (considered after employment ends) or one year after employment ends, whichever is later.

Documents may be stored on paper or electronically. Only sections bearing an employee or employer input need to be kept.

Penalties for Non-Compliance

Form I-9 paperwork violations typically incur a fine of between $281 to $2789 per violation. Fines usually increase with each subsequent violation.

If an employer knowingly hired or continued to employ an unauthorized employee, the fines range from $689 to $27,894 per worker.

Best Practices to Consider

- Never dispose of the Form I-9 of an active employee

- Consider storing electronically

- Regularly review your I-9 process and consider quarterly internal audits

- Consider I-9 management

- Consider omitting acceptable documents pages, instructions, and supplement pages from storage

- Organize documents by name or hire date for easy retrieval

- Keep form I-9 documents separate from all other personnel files